Selling a business is a significant decision that requires careful planning and astute strategizing.

Most of a business owner’s profit over the lifetime of their business is made during an exit. Statistically speaking, a majority of businesses never actually achieve a successful exit, let alone one with a maximum valuation. How you exit your business and who you work with can significantly determine your chances of success and how much money you are left with after selling your business.

Preparing a business for sale requires careful planning and execution. It involves evaluating your company's financials, operations, and market position to identify areas of improvement and increase its attractiveness to potential buyers. By addressing any weaknesses and enhancing their strengths, you can significantly enhance the value of your business.

One key aspect of preparing a business for sale is conducting a thorough valuation. Understanding the true worth of your company is essential for setting a realistic asking price and negotiating with potential buyers effectively. By enlisting the help of experts in business valuations, you can gain insights into your company's value drivers and optimize them to achieve maximum returns.

At the Exit Advisor, we specialize in helping entrepreneurs like you sell their businesses for maximum value. Our team of experienced advisors understands the intricacies of the buying and selling process, and we provide tailored guidance to ensure a smooth and successful sale.

In the upcoming sections, we will delve deeper into the steps involved in selling a business, including finding potential buyers, negotiating deals, and closing transactions. So, to sell your business with maximum value, keep reading for expert advice and actionable tips.

I covered 9 steps to sell your business. Not only this but a comprehensive guide is also provided about how to make a profitable exit once the business is sold. So, if you are ready to sell a business without a broker, keep reading.

| Before You Start! |

|---|

| When embarking on the journey to sell your business, devote extra care to documenting and organizing financial records. A well-kept financial history instills confidence in potential buyers and expedites the due diligence process, smoothing the path to a successful sale. |

Step 1: Prepare Your Business for Sale

The first step in selling your business is preparing it for sale. This includes addressing questions from potential buyers, maintaining confidentiality, and organizing records while preparing mentally for the sale.

Addressing Questions from Potential Buyers

Potential buyers will have many questions about your business. These cover profit margins, customer base, growth potential, and business operations.

Selling an online business is a complex task. The new owner asks many questions about whether the business is worth it, so some positive steps you can take are to be prepared to answer the questions with detailed, accurate, and honest answers. This will build trust with prospective buyers and expedite the sale process by reducing back-and-forth discussions. It is important to conduct a full audit of your operations, marketing, sales, etc, and have answers to common questions.

A buyer or operator would have to run your business successfully without your help, so they need maximum information about your business. That’s why getting ready for answers is essential.

Maintaining Confidentiality

Many small business owners make some mistakes when it comes to sell faster. Confidentiality is crucial during the sale process to protect the sensitive information of your key business. Adequate measures will ensure that information is only shared with serious potential buyers. You must use non-disclosure agreements to bind business buyers and maintain legal confidentiality.

There are many pretend buyers out there who are not interested in acquiring businesses and instead are looking for a competitive edge or market research for their purposes. There are also a vast majority of buyers who do not have the access to capital to afford the acquisition of your company. Be sure to keep these tire kickers in mind when dealing with potential buyers and sellers inquiries.

Avoiding Mistakes: Organizing Records and Mental Preparedness

A common mistake during the sale process is needing to be organized. When you're ready to sell, ensure all business records – financial statements, tax returns, employee details, and customer information – are up-to-date and easily accessible. Furthermore, selling a business can be emotionally challenging.

Being mentally prepared for the negotiation process and eventual transition is crucial. In the M&A space, we refer to what is known as a Data Room, where all files related to the marketing materials, P&L, and other related files are stored for viewing by potential buyers.

The more organized your data room, the more attractive your business will appear, especially when buyers compare shops to other businesses. Staying organized helps demonstrate you have your business in operational order and helps build trust for a maximum exit.

Step 2: Determine the Value of Your Business

Business Valuations in Today’s Economy

Determining the value of your business is a critical step in the selling process. It's essential to consider several factors, including your business's assets, revenue, market conditions, and industry trends, to show your company is worth it.

In today's dynamic economy, it's also important to factor in economic uncertainties and their potential impact on your business. A thorough and objective valuation will help you set the best price and competitive asking outlay to attract serious buyers.

Timing is a consideration when exiting for maximum value. Consider macro trends in the M&A space, valuation multiples in your industry, the operations and trends within your specific market and niche, and your timeline for an exit.

There is no “perfect” time to sell your business. However, it's always easier to exit at a premium value when your business profit is increasing or, at a minimum, steady. It is too common for business owners to hold on to their business only to try to exit when things aren't going well.

“Buyers decide in the first eight seconds of seeing a home if they’re interested in buying it. Similarly, when selling a business, make those initial moments count. Present a compelling snapshot of your business's value to capture buyer interest and set a positive tone for negotiations.”

Barbara Corcoran,'Shark Tank'

Getting engaged with an advisor early is better to assist with timing and preparing potential buyers for acquisition at the right time. No buyer wants to catch a falling knife.

Work with an Experienced Team

An experienced team can help you maximize your valuation. In business, you may conduct transactions daily, weekly, etc. However, when you exit your business, it is 1 transaction and a large one. Now is the time to engage an advisor to help you navigate the nuance and common pitfalls that leave you missing hundreds of thousands of dollars in value.

Get a professional valuation with the help of an evaluator who can provide invaluable assistance in accurately valuing your business. They can offer a solid plan and expert insights into your financials, help identify areas for improvement, and suggest strategies to increase profitability. By having a professional assist in your business valuation and diligence, you can assure potential buyers of the reliability of your financial information and operations.

Increasing Business Profitability

Boosting your business's profitability can significantly enhance its market value. Some strategies include improving operational efficiency, streamlining business processes, diversifying product or service offerings, and strengthening customer relationships. Remember, a business with consistent revenue growth and healthy profit margins is more likely to attract and retain serious buyers, leading to a successful sale.

Scaling is important, but sometimes, pulling all of your last efforts to increase profitability can hurt your valuation. You want to leave a clear roadmap for potential buyers to add value they may need to see. Put heavy consideration on what will drive up your valuation without over-optimizing your business and leaving little to no room for growth in the buyer's eyes.

Step 3: Clean up Your Accounting Records & Financial Processes

Improving Financial Statements

Ensuring your financial statements are clean, organized, and transparent is critical in sales. Potential buyers will scrutinize these documents to assess the financial health of your business. Your balance sheet, income, and cash flow statement should reflect your company's financial position accurately. Any discrepancies or irregularities could raise red flags and deter buyers.

Therefore, consider obtaining an audit form to verify your financial statements and tax returns. This supports the integrity of your financial information and boosts buyer confidence. Leveraging software like QuickBooks is a common plan of action to support a clear P&L and strong accounting.

However, there are many ways to add value to your financial statements, specifically around “Add Backs,” which are expenses the future business owner is not expected to incur. Add-backs can be complex and significantly impact the value of your business. At the fundamental level, addbacks should clear out expenses to reflect a business's operational and financial health. One-time write-offs for a personal vacation to Hawaii may not be an expense that accurately reflects your company’s financial health.

Enhancing Business Value Pre-sale

Enhancing your business value can profoundly impact the final sales price. This could involve several measures, such as addressing any outstanding legal issues, securing key customer contracts, or investing in assets that could increase profitability.

Moreover, ensure your business can function without you by having a skilled management team. A business that demonstrates smooth operations without owner involvement is highly attractive to buyers as it reduces potential transition risks. These presale enhancements can significantly boost your business's appeal, leading to a higher sales price and a smoother selling process.

Step 4: Deciding to Sell

Identifying the Reasons for the Sale

Before embarking on the sale of your business, it's crucial to understand and articulate your reasons for selling. These reasons include retirement, pursuing a new venture, illness, or simply wanting change. Your motivations for selling can significantly influence the timing, price, and negotiations of the sale process. Being transparent about your reasons can also build trust with potential buyers, making them more comfortable with the purchase. Whatever your reasons for selling, they should, at a maximum, be reflective and in line with the health of your business.

Deciding the Timing of the Sale

Choosing the right time to sell your business is a decision that requires careful thought and strategic planning. It's important to consider external factors, such as market conditions, industry trends, economic outlook, and internal factors, like your business's financial performance and growth potential.

Personal circumstances and plans should also play a role in deciding the best time to sell. Making a well-informed decision on timing can maximize your business’s value and facilitate a smoother sale process.

When to Sell Your Business

The best time to sell your business is when it’s performing well with good growth prospects. This maximizes your business's market value and makes it more attractive to potential buyers. Moreover, an eye on the larger economic landscape and industry trends can help identify the most opportune moments to sell. Remember, timing your exit right can pay off significantly in the final sales price.

How Much to Sell Your Business For

Pricing your business right is a delicate balance. Set the price too high, and you risk alienating potential buyers; set it too low and leave money on the table. The price should reflect your business's true value, considering its assets, earnings, market position, and future earning potential. An accurate valuation, typically conducted by a professional business evaluator, can guide you in setting a fair and justifiable asking price.

Where to Sell Your Business

Choosing the right platform or avenue to sell your business is critical to reaching the most suitable pool of potential buyers. This could involve hiring a business broker, listing it on business-for-sale websites, or leveraging your network.

Choosing a method that aligns with your business type, size, and industry is important. This ensures you attract buyers with the interest and capability to take your business forward, leading to a successful and satisfying sale.

The biggest risk of going at this alone is time and a reduced buyer pool, ultimately leading to significantly lower valuations, fewer offers, or an unsuccessful exit. Here, you want to engage an advisor who understands all exit paths, private buyer networks, current broker trends, and other variables to help you navigate a premium exit.

| Did You Know? |

|---|

| Researching market trends and understanding industry dynamics can significantly enhance your negotiating position? Being aware of your industry's landscape enables you to highlight your business's unique value proposition and justify its asking price. |

Step 5: Engaging With Professionals

Selling a business quickly is a complex process requiring experience, knowledge, and skill. It's where professionals come into play. They can help navigate the intricate complexities to ensure a seamless and successful business and make a profitable exit.

Hiring a Broker

When selling an intellectual property, hiring a broker can be a game-changer. By leveraging their extensive network, accountant strategies, and proven expertise, brokers can bring in serious buyers, negotiate better deals, and handle cumbersome paperwork. But remember, all brokers are not created equal. So, take the time to research, interview, and select a broker whose experience and style align with your needs.

The Role of a Broker

A broker is your ally and advisor throughout the selling process, handling everything from business valuation and marketing to buyer screening and closing negotiations. They act as the buffer between you and the buyers, providing professional guidance at each step and ensuring your interests are well represented. It's their job to make the selling process as smooth, efficient, and profitable as possible.

Evaluating Broker Costs

While hiring a broker can offer immense benefits, it doesn't come without cost. Usually, brokers charge a commission based on the final selling price, typically ranging from 5% to 12%. Some premium brokers will even charge an upfront cost of between $2,000 and $15,000 as an engagement fee to start their services. They do this to offset the risk of you being unable to exit.

It's important to weigh these costs against the potential advantages and only work with advisors and borrowers who truly add value and understand how to navigate all exit paths. The value a professional broker brings to the table should easily offset the commission you might pay.

Working with the Exit Advisor

On the other hand, our company, the Exit Advisor, is a specialist who helps plan your exit strategy, ensuring your business is in the best possible shape when you decide to sell. We deeply understand the sales process and can provide strategic insights to maximize your business's value. Working with us can be a strategic move, setting the stage for a successful sale.

How the “Exit Advisor” Can Help

We at Exit Advisor” can provide invaluable guidance on various aspects of the sales process, such as optimizing business value, negotiations, buyer sourcing, planning exit strategy, and managing post-sale transitions. Whether improving business operations, resolving issues, or streamlining financial records, we can identify and address areas that can help increase your business's appeal to potential buyers.

Choosing Between Selling Yourself and Using a Business Broker

The decision to sell your business yourself or hire a business broker depends largely on your comfort level with managing the sales process, your knowledge of the market, and the complexity of your business. It's a decision you should weigh carefully.

While selling the business yourself can save your broker's commission, the time, effort, and potential risks involved might outweigh the savings. On the other hand, a business broker can bring expertise and resources that can increase the likelihood of a successful sale.

Seller Financing Options

Seller financing, where the seller offers a loan to the buyer to purchase the business, can open up opportunities for more buyers and potentially a higher selling price. However, it comes with risks, including delayed payment and buyer default. If you're considering seller financing, it's important to discuss it with a financial advisor or lawyer to understand the potential implications and to ensure that any agreements are legally sound and reflect your interests.

Seller Financing can also be tied to a similar definition known as an “Earn-Out.” The main difference is that an earn-out is usually tied to the business's future performance versus Seller Fiancing, where the Seller is owed the outstanding balance regardless of how the new buyer performs.

Step 6: Determine the Valuation and Financials

Delving into the world of numbers, the sixth step of selling your business involves valuation and financials. It's crucial to accurately determine the worth of your business to attract the right buyer and negotiate an optimal deal.

Business Valuation Process

The business valuation process is more than just numbers; it's an art that requires deep understanding and expertise. A correct valuation is a delicate balance between financial history, market conditions, and future growth prospects. It's advisable to seek professional help to guide you through this process, ensuring your business is priced attractively yet competitively.

Factors Impacting Business Valuation

Many factors can impact your business's valuation, from tangible assets and profits to intangible elements like market reputation, customer base, and growth potential. Understanding these factors can help you better present your business to potential buyers. It can also provide insights into areas of improvement that can contribute to an increased business value.

Timing Considerations

Choosing the right time to sell can significantly influence your business valuation. Economic conditions, industry trends, and market demand can all affect the perceived value of your business. Being mindful of these timing considerations can help you seize a profitable selling opportunity when it arises.

Maintaining Clean and Well-documented Financials

A well-organized and comprehensive record of your business's financials can do wonders for your credibility and trustworthiness in the eyes of potential buyers. It portrays transparency, honesty, and meticulous management, all of which are attractive buyer qualities. Remember, the cleaner the financials, the smoother the negotiations.

Seller Financing Management

As mentioned, seller financing can be an attractive option for potential buyers, but it's important to remember that it must be represented accurately in your financial documentation. Ensure that the terms of the seller financing are clearly outlined, including interest rates, repayment schedule, and consequences of default.

Audited Financials and Liabilities

Presenting audited financials and a clear record of liabilities can enhance buyer confidence in your business. An independent financial audit verifies the accuracy of your financial statements, providing an unbiased view of your business's financial health. Likewise, a well-documented liabilities record assures buyers that no hidden financial risks are associated with your business.

Step 7: Finding a Buyer to Sell the Business

Finding the right buyer for your business is a journey that requires strategic planning, patience, and an intuitive understanding of the market. It's not just about attracting attention; it's about attracting the right attention. Your focus should be on targeting individuals or entities that align with your business's ethos and future vision.

Choosing a Platform to Sell Your Business

In today's digital age, multiple platforms are available for selling a business. From online marketplaces and brokerage firms to social media channels, each platform offers unique benefits and serves different types of buyers. Identifying and selecting a platform that best suits your business type, size, and industry is important. You want a platform that amplifies your presence to the most relevant audience.

Evaluating Online Platforms

When evaluating online platforms, consider their user base, success rate, cost, and the kind of support they offer. A platform with a large active user base of potential buyers increases the probability of your business being spotted by the right buyer. Also, check reviews or testimonials to understand the experiences of others who have sold their businesses through these platforms.

Attracting Qualified Buyers

As you would put effort into a winning sales pitch to secure a client, attracting qualified buyers requires strategy and finesse. Your business listing should be compelling and truthful, demonstrating the value a potential buyer would gain. Highlight your business's strengths and achievements, and articulate the growth potential clearly.

Finding a Pre-qualified Buyer

Pre-qualified buyers have already demonstrated their financial capacity and genuine interest in buying a business. Connecting with such buyers can save time and make the sale process smoother. Networking events, industry forums, or business brokers can serve as avenues to meet pre-qualified buyers.

Qualifying Potential Buyers

Before diving into negotiations, vetting and qualifying potential buyers is important. You must ensure they're financially capable and genuinely interested in your business. This step might involve checking financial statements and business history and conducting preliminary interviews. Remember, it's not just about selling your business; it's about ensuring its continued success.

Vetting Prospective Buyers:

Vetting prospective buyers involves a series of checks and balances to ensure they are the right fit for taking over your business. This process could involve financial background checks, understanding their business acumen and plans for the business, and even gauging their compatibility with your existing team or business culture. It's important to be thorough in this step to ensure a smooth transition and future success of the business.

Other Factors to Consider in Buyer Qualification

Beyond financial capacity and interest, other factors like the buyer's industry knowledge, vision for the business, and even gut instinct play a crucial role in buyer qualification. You want to be confident that the buyer will drive your business toward continued growth and success. It's also important to consider the chemistry during your interactions, as a harmonious relationship will make the sales process much easier.

Step 8. Closing the Deal

Closing the deal is a pivotal step in the business selling journey where meticulousness and attention to detail are paramount. This is the stage where the fruits of your efforts come to fruition, and careful navigation is required to ensure a smooth finale for your business sale.

Finalizing Contracts

Finalizing contracts is more than just signing off on a piece of paper. It's the concrete manifestation of your negotiations and agreements. To ensure accuracy, you should meticulously review every clause and condition in the contract. Legal advice may be beneficial during this stage to ensure all sale facets—including terms, price, and potential liabilities—are adequately addressed within the contract. The aim is to safeguard your interests and leave no room for ambiguities that could lead to post-sale disputes.

Handling the Profits

The next step is strategically handling the profits once the contracts are finalized and the sale is complete. Financial planning is critical to maximize your post-sale wealth. Whether you opt to invest in another venture, plan for your retirement, or simply want to enjoy your success, having a financial advisor can prove helpful. They can guide you on tax-efficient ways to handle your profits, aligning with your long-term financial goals.

Timeframe for Selling a Business

How Fast Can You Sell?

The speed at which you can sell your business can vary widely based on several factors. These may include the market state, the attractiveness of your business to buyers, and the efficiency of your selling process. It could take anywhere between 1 month to two years. This timeline can be drastically shortened by working with professionals with contacts to help bring buyers to the table and navigate the fastest exit path based on your current situation.

However, bear in mind that haste can often lead to less-than-optimal outcomes. The key is to balance promptness and patience to ensure you receive a deal that meets your expectations.

Average Time to Sell a Company

Selling a company may take around 2 to eleven months. This timeframe accounts for initial preparation, business marketing, negotiations, due diligence, and closing the deal. However, this timeline is flexible. It could extend if the right buyer is not found promptly or due diligence uncovers issues that must be resolved. Patience, perseverance, and a well-thought-out exit strategy can aid in navigating this journey effectively.

Generally speaking, the larger and more complex the business, the longer it will take to sell. Most businesses valued under $5M should expect to exit under 6 months; above that, your time for exit may extend.

Step 9. Addressing Concerns

Like in any major endeavor, selling a business can raise several questions. It's only natural to harbor uncertainties and fears about the unknown. However, addressing these concerns head-on alleviates apprehension and fuels a smoother and more predictable sales process.

Post-Sale Industry Competition

One such concern could be about post-sale industry competition. Sellers often wonder about their role in the industry or market post-sale, especially if they plan to start a new venture in the same sector.

Binding contracts, such as non-compete agreements, can play a significant role in assuaging these concerns. These agreements can outline clear terms and conditions about your involvement in the industry, thereby eliminating ambiguity and setting the right expectations for both parties.

Employee Transition After Sale

The transition of employees after the sale is another key concern. You have built a team, nurtured relationships, and fostered a unique culture; hence, worrying about your employees' fate post-sale is natural.

You can discuss this matter during negotiations with potential buyers and create an effective transition plan. This plan could include agreements on retaining current staff, honoring existing contracts, and even offering reassurances to your team. A well-structured approach can help minimize disruption and foster security amidst the change.

Navigating Liabilities

Navigating liabilities post-sale is a significant consideration. When selling a business, you want to ensure you're released from obligations tied to the business after the sale. This requires meticulously reviewing contracts and agreements to transfer obligations or settle them before the sale correctly. Engaging legal aid can be a prudent move to navigate this complex step.

Audited Financials Requirement

Lastly, the requirement for audited financials could be a point of concern. Buyers often require audited financial statements as they provide a reliable, third-party view of your business's financial health. If your business still needs audited financials, investing in an audit could be worthwhile before listing your business for sale. This instills confidence in potential buyers and expedites the due diligence process.

In the journey of selling a business, it's normal to face various concerns. However, remember that these concerns are stepping stones, not roadblocks. With a clear strategy, diligent planning, and a transparent approach, you can address these concerns effectively, ensuring a successful sale and a bright future for your passionately built business.

Key Notes to Understand

Most business owners fear building a business for exit and then being a slave on the backend to support it. Many leverage points can be used in negotiating other than valuation to ensure you are left on the best terms post-exit or merger.

- Consider your time, how you engage with your buyer, through what medium, and how often. What stipulations, if any, are you required to come back?

- Consider options where missed payments or sub-performance on earn-outs or seller financing entitle you to a portion of your business back, if not all.

- Double-dipping an exit only to be paid to return to fix what you already know and then exiting again is not as uncommon of a story as you may hear. Tag up with an Exit Advisor to ensure you have these safeguards and options available.

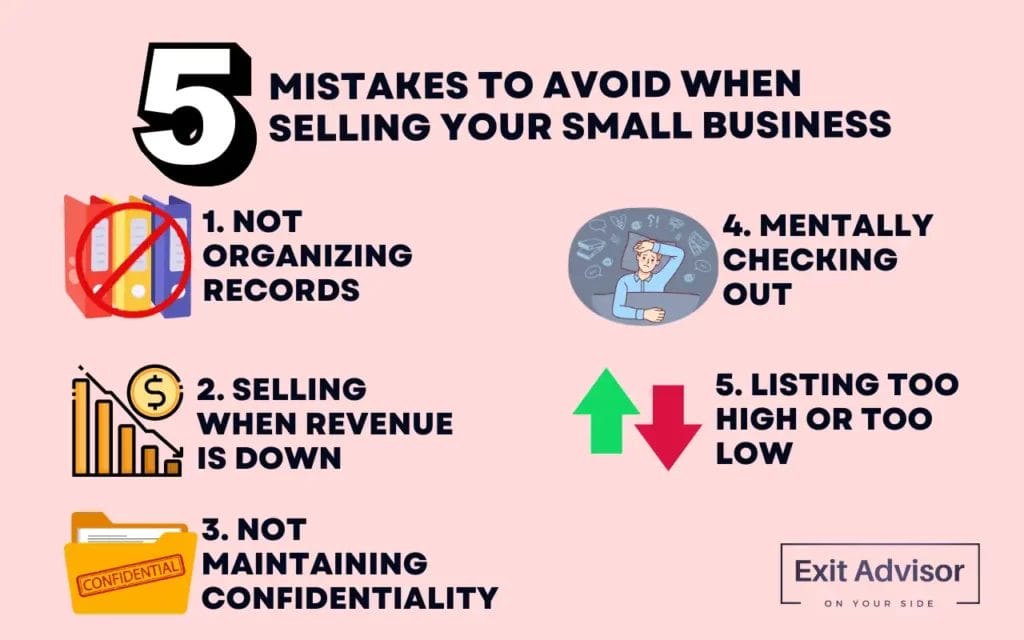

6. Mistakes To Avoid When Selling Your Small Business

Throughout the complex process of selling a business, mistakes are often inevitable. However, knowing these common pitfalls can help you navigate the process more effectively. Here are some mistakes you should strive to avoid:

1. Not Organizing Records

One common mistake many business owners make is that they need to pay more attention to organizing their records. This lack of organization can make your business appear unprofessional to potential buyers, potentially decreasing your business's value.

What To Do Instead

To avoid this, ensure that all your financial records, contracts, and other business documents are well-organized and up-to-date. The more organized and transparent your records are, the more confidence potential buyers will have in the reliability of your business.

2. Selling When Revenue Is Down

Some business owners may decide to sell their business when its revenue declines. However, this can significantly decrease the selling price.

What To Do Instead

Selling your business when it's performing optimally is advisable, as this will increase its value. If you need to sell during a downturn, you should be prepared to justify the current state of your business and provide a convincing future growth strategy.

3. Not Maintaining Confidentiality

Revealing too much information about your business sale can lead to unnecessary problems such as staff morale issues, customer defections, and competition exploitation.

What To Do Instead

It's crucial to maintain confidentiality until an appropriate time. This can be achieved using a non-disclosure agreement (NDA) with potential buyers to protect sensitive information.

4. Mentally Checking Out

Once the decision to sell has been made, some owners mentally check out of their business, leading to a decline in performance that could discourage potential buyers. Most of the time, the business owner or buyer lets their emotions get in the way. They either rush the exit or don’t let potential buyers ask the hard questions and get support to help you translate the value of what you already built to a buyer willing to hear it.

What To Do Instead

Stay engaged, level-headed, and invested in your business's success until the end. This not only provides a positive impression to potential buyers but also helps maintain the value of your business.

5. Listing Too High or Too Low

Setting the right price for your business is crucial. A price tag that's too high can scare away potential buyers, while a price that's too low may lead to a significant financial loss. Most of the time, you only have one shot for a potential buyer. Aim too high or too low, and you won't even be able to bring them to the negotiation table.

What To Do Instead

Consider getting a business valuation from a professional to determine a fair and realistic price. This will provide an objective, third-party perspective on your business's worth. Focus on getting the potential buyer to the table or Zoom room if you prefer, and negotiate from there.

Will My Employees be Laid Off After I Sell?

Mostly, the fate of your employees after a sale depends on the buyer's plans for the business. Many buyers intend to keep the existing team due to their experience and knowledge of the business. However, sometimes, a buyer may bring in their team. Discussing this issue with potential buyers and notifying your employees about the sale and potential impact is essential.

The best thing to ensure a smooth transition is to have a team that operates without your input and is affordable to the company P&L. One of the first things a new buyer will do is look to cut expenses. However, they will not easily want to fix what is not broken, so instead, they focus on cleaning up operations and expenses ahead of time to reduce friction and turnover on exit.

You may be nervous, want your current employees to come with you, or have stability with a new buyer. These points will be important to weave into negotiation and deal terms while also considering the best time to notify employees of a potential exit.

Frequently Asked Questions

Can I compete in the same industry after I sell my business?

Contrary to popular belief, Yes, you can compete in the same industry after selling your business unless you've signed a non-compete agreement as part of the sale. This document may restrict you from starting a similar business within a certain geographical area and time frame. All this happens in negotiation. The more you show you are not “directly” competing with your buyer, the better off you will be for your next venture. Specificity and clarity in your acquisition agreements will be crucial.

Will I need audited financials to sell my business?

While it's not always a requirement, having audited financial statements can make your business more attractive to potential buyers. These documents assure the financial health of your business and can often expedite the due diligence process. However, the necessity of audited financials can depend on the size and complexity of your business.

How fast can I sell my business?

The timeline for selling a business can vary widely based on several factors, including the size and complexity of the business, the industry, and the current market conditions. Generally, business selling can take a few months to several years. Those looking for an exit under 30 days should adjust expectations. However, it is possible to have a premium exit in under 30 days if you work with those with the right connections and experience to drive value clearly to a new buyer and bring the network with hungry buyers ready for acquisition.

Conclusion

The journey of selling a small business is complex yet manageable with strategic planning, diligent organization, and mindful decision-making. We've walked you through the key steps, shedding light on potential concerns and common mistakes to avoid. It's crucial to remain engaged, keep records organized, maintain confidentiality, set a realistic selling price, and carefully choose your representation.

Remember, every concern you encounter on this journey is a stepping stone towards a successful sale. It is the end of an era and the beginning of a new chapter for you and the business you've passionately nurtured. Therefore, it's worth the time and energy to ensure you are leaving your valuable legacy in the right hands.

Even though the process might seem daunting, you can navigate it successfully with the right approach. You've built a thriving business; trust your ability to sell it effectively. Stay focused, be patient, and keep your ultimate goal in mind.

Whether you are selling your business now or next year, consider booking a discovery call with Exit Advisor now to ensure you have all exit paths available for a maximum exit. Some of the best paths to a premium valuation should be set up months, if not a year or more, in advance.

Most business owners never actually exit, let alone sell multiple businesses. It's worth educating yourself and working with professionals on the biggest transaction of your life. At Exit Advisor, we are on your side and in the corner to the very end. Feel free to contact us to see how we can support you with your exit.