Selling a failing business can be a challenging and emotional experience for any entrepreneur.

After pouring your time, money, and efforts into starting and growing your business, it can be disheartening to realize that it is not performing as well as you had hoped. However, this is a reality many businesses face at some point in their operation.

The decision to sell a failing business is not easy, but it may be necessary for your financial and mental well-being. Selling a failing business that is losing profit requires careful consideration and planning to ensure you get the best possible outcome.

Understanding the Situation

Before making any choices about selling your business, conducting a thorough business valuation is crucial to understand your company's present status genuinely. Take a step back and evaluate the reasons why your business is struggling. Is it due to external factors such as a changing market or economic downturn? Or are there internal issues within the company, such as mismanagement or high overhead costs?

It is crucial, to be honest with yourself and identify the root causes of your business's failure. This will help you make an informed decision and present a clear and compelling case to potential buyers.

What Determines If Your Business Is Failing?

- Declining revenue and profits: A significant decrease in sales and profitability over a sustained period indicates a struggling business.

- Negative cash flow: When your expenses outweigh your income, and you consistently lose money, it is a sign of financial distress.

- Unpaid debts: If your business has accumulated significant debts that you cannot pay off, it may be viewed as a red flag by potential buyers.

- Employee turnover: High employee turnover can indicate underlying issues within the company, such as low morale or poor management.

Every business wants the best price, while money should be a last priority. Many small business owners don't understand the hidden value and don't understand how to make the business profitable. You must know the significant value of the business because it will help with selling. Monitoring these indicators closely and promptly addressing any issues is essential to prevent your business from declining further.

Is It Difficult to Sell a Failing Business?

If your business isn't making money, it may be challenging to sell it, but not impossible. Find out what it's worth and accurately value it because business evaluation will clarify the true earning capacity of this business. With the right approach and preparation, you can find a buyer who sees potential in your struggling business.

One of the most crucial factors in selling a failing business is timing. It would be best to proactively recognize the signs of a failing business and promptly address them. The longer you wait, the more challenging it may become to find a buyer willing to take on a struggling business.

Another key aspect is presenting your business in the best possible light. This includes having accurate financial records, identifying potential growth opportunities, and addressing underlying issues contributing to the business's decline. Working with business professionals or consulting with an experienced advisor can help you navigate future profits more effectively.

Things You Must Know Before Selling an Unprofitable Business

Selling a failing business is about more than finding a buyer and exchanging money. Before making any decisions, educating yourself on the process and potential challenges you may face is crucial.

Some important things to know before selling an unprofitable business include:

1. Understand How Much Your Business Is Worth

It is essential to have an accurate valuation of your business before putting it on the market. This will give you a realistic idea of what you can expect to receive from the sale and help you set a fair asking price.

Selling a failing business may bring in less profit than selling a successful one. Having realistic expectations and being prepared to negotiate with potential buyers is crucial.

2. Know the Difference Between Selling Distressed vs. Profitable Business

Selling a distressed business successfully means selling it in its current state, with all its issues and challenges. On the other hand, selling a profitable business means finding a buyer willing to pay for the potential growth and success of the company.

Understanding this difference can help you tailor your marketing approach to potential buyers. If you are selling a distressed business, being transparent and upfront about its current state is crucial. However, if you believe your business still has potential for growth and success, highlighting these opportunities can make it more attractive to buyers.

3. Business Liquidation as an Exit Strategy

In some cases, selling a failing business may not be an option. If your business is in significant debt or has no potential for recovery, liquidation may be the only viable exit strategy.

Liquidation involves selling off all the company's assets and distributing the funds to creditors. It should be viewed as a last resort but may be necessary in certain situations. If you are considering liquidation, it is essential to consult with a legal and financial advisor to ensure the process is done correctly.

4. ‘Asset Sale’ Values Business Based on Tangible Assets

When selling a failing business, the value is often determined by its tangible assets rather than future potential. This type of sale is an asset sale and can benefit buyers looking to acquire specific equipment or property.

Understanding the difference between an asset sale and a traditional business sale can help you determine which option may be more suitable for your struggling business.

Selling a failing business is not just a transaction; it's a strategic maneuver. Success lies in understanding the nuances, valuing assets wisely, and navigating the process with resilience.

ExitAdvisor.io

5. Increase Company Sales and Financials for a Profitable Exit

Ensuring your company's financials are in good standing is crucial when selling a failing business. This will increase your business's value and make it more attractive to potential buyers.

One way to improve your company's financials is by increasing sales. Implementing marketing strategies and improving customer relationships can boost sales and profitability. It may also be beneficial to cut unnecessary expenses and streamline operations to reduce costs.

Significant improvements or advancements in your business can make it more attractive to potential buyers. For example, investing in new technology or diversifying your product line can demonstrate growth potential and increase the overall value of your business.

6. Owner Need To Be Involved in Business Cash Flow

Owners must be actively involved in their business's day-to-day operations during the selling process. This will ensure that the business continues to run smoothly and give potential buyers a sense of security and confidence in the company's management.

As a small business owner, staying informed and up-to-date on all aspects of your business, such as finances, operations, and customer relations, is essential. This will not only help with the selling process but also ensure the success of your business until it is transferred to new ownership.

7. Find the Right Broker to Sell Your Business | Call ExitAdvisors.io

Selling a failing business can be a complex and daunting task, but it is not something you have to do alone. Consider hiring a professional business vendor or advisor to guide you through selling and protect your interests.

ExitAdvisors.io offers brokerage services for small businesses looking to exit efficiently and profitably. Our experienced advisors will work with you every step, from preparing your business for sale to finding qualified buyers and negotiating a successful deal.

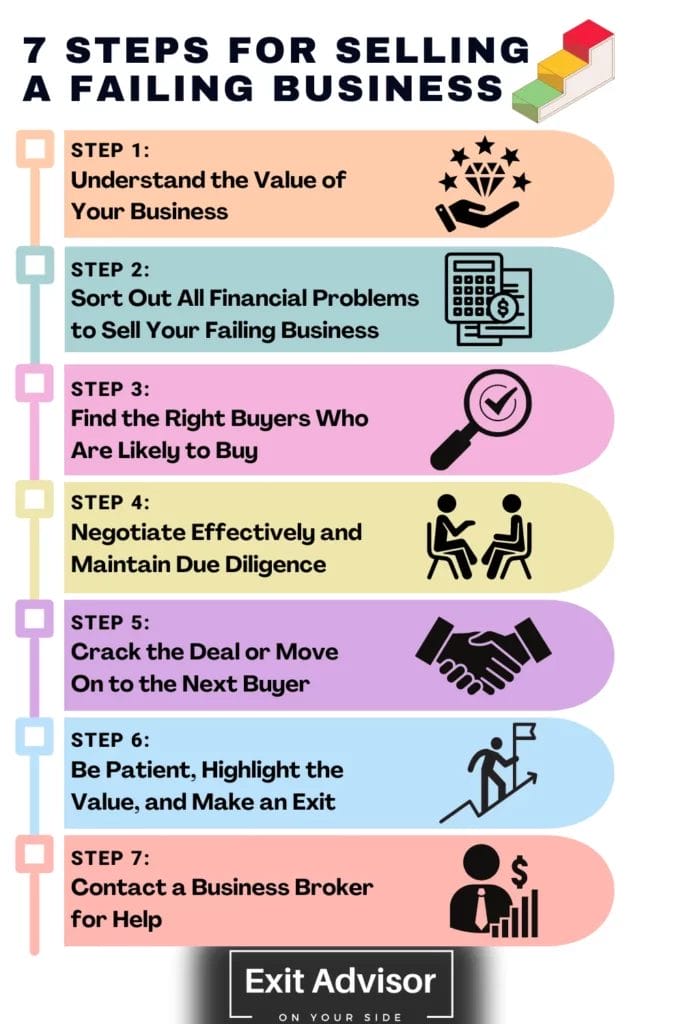

7 Steps for Selling a Failing Business That is Losing Money

Selling a failing business can be a challenging and emotional process. However, with the right approach and guidance, it is possible to make a successful sale and exit your struggling business on a positive note.

Here are some essential steps to follow when selling a failing business.

Step 1: Understand the Value of Your Business

Selling a failing business can be a challenging and emotional task. However, finding a buyer who sees potential in your struggling venture is possible with the right approach and guidance. The first step in selling a failing business is understanding its current value. This will help you set realistic expectations and make informed decisions throughout the selling process.

How to Value a Business on the Market Terms

Valuing a business losing capital can be more complex than valuing a profitable business. Traditional valuation methods such as price-to-earnings ratios or discounted cash flow analysis may not accurately reflect the true worth of a struggling enterprise. Instead, other approaches need to be considered.

- Asset Valuation: One way to value a failing business is by assessing its tangible and intangible assets. Tangible assets include equipment, inventory, and property, while intangible assets include intellectual property, customer relationships, and brand value. Evaluating all assets and determining their fair market value is essential.

- Cash Flow Analysis: Even if a business loses money, it may still have positive cash flow. Analyzing the cash flow can provide insights into the company's ability to generate revenue and repay debts. Potential buyers may be interested in acquiring a failing business with a positive cash flow if they can identify opportunities to turn it around.

- Industry Comparables: Researching the market and analyzing similar businesses that have been sold recently can provide valuable insights into the potential value of your struggling venture. Look for businesses in the same industry and region to compare their financials, growth prospects, and selling prices.

- Future Earnings Potential: While a failing business may be struggling, it is crucial to consider its future earning potential. Is there a possibility for a turnaround or strategic changes that could lead to profitability? Assessing the growth prospects and market dynamics helps establish a realistic value based on potential future earnings.

Get Consultation on Valuing Your Distressed Business

Valuing a failing business requires expertise and experience in distressed business situations. To ensure you accurately assess the value of your struggling venture, it is advisable to seek consultation from professionals who specialize in valuing distressed businesses.

These experts can provide valuable insights and guidance throughout the process, helping you navigate the complexities and maximize the potential value of your business.

| Did You Know! |

|---|

| Valuing a struggling business requires a unique approach, considering tangible assets, cash flow, industry comparables, and future earning potential. Seeking professional consultation is key to an accurate assessment. |

Step 2: Sort Out All Financial Problems to Sell Your Failing Business

Once you understand the value of your failing business, the next step is to address and sort out any financial problems hindering its potential sale. Potential buyers will want to assess the financial health of your business, so it is crucial to be transparent and proactive in resolving any outstanding issues.

Be Transparent With Your Financials

Transparency is key when dealing with the financial aspects of your failing business. It is essential to provide potential buyers with accurate and up-to-date financial statements, including income statements, balance sheets, and cash flow statements. Being transparent with your financial information helps build trust and credibility during negotiations.

Review your business's financial records to identify outstanding debts or obligations. This includes loans, unpaid bills, tax obligations, and other financial obligations that must be addressed. Make a comprehensive list of all debts and prioritize them based on urgency and impact on the business's financial health.

Ensure your business complies with all legal and regulatory requirements. This includes resolving outstanding legal disputes, obtaining necessary permits and licenses, and ensuring compliance with employment laws and regulations.

By being transparent with your financials and actively addressing financial problems, you increase the chances of attracting potential buyers who see the potential in your struggling venture. Remember, sorting out financial issues requires diligence, perseverance, and a commitment to finding the best possible solutions for your business.

| Remember! |

|---|

| Transparency is the cornerstone of selling a failing business. Be honest about financial challenges, address issues proactively, and build trust with potential buyers for a smoother negotiation process |

Step 3: Find the Right Buyers Who Are Likely to Buy

Once you have addressed the financial problems of your failing business, the next step is to identify potential buyers who are more likely to consider purchasing your business. Finding the right buyer is crucial to ensure a successful sale and a smooth transition.

Maintain Healthy Relationships With Potential Buyers

Building and maintaining relationships with potential buyers is essential during the selling process. By establishing open and honest communication channels, you can cultivate a sense of trust and credibility, making it more likely for buyers to consider your business seriously.

Attend industry events, conferences, and business gatherings to connect with potential buyers. Building a network of contacts within your industry can help you identify interested parties who may be looking for an opportunity like yours.

Social media platforms like LinkedIn can also be valuable tools to expand your network and connect with potential buyers.

Be Honest With Buyers

Honesty is crucial when dealing with potential buyers. Transparency about the strengths and weaknesses of your failing business helps establish trust and ensures that both parties have a realistic understanding of the opportunities and challenges ahead.

Provide potential buyers with all relevant information regarding the business, including its financial performance, customer base, market conditions, and ongoing legal or operational issues.

Be transparent about the current state of your business and set realistic expectations for potential buyers. Communicate any limitations or challenges they may face during the ownership transition and the steps required to turn the business around.

Setting realistic expectations helps to manage buyer's expectations and reduces the risk of disappointment or misunderstandings later on.

Step 4: Negotiate Effectively and Maintain Due Diligence

Negotiating the sale of your failing business is a critical step in the process. Effective negotiation skills can help you secure the best possible deal and ensure a successful transaction.

When entering into negotiations with potential buyers, knowing and leveraging your strengths is essential. Understanding what makes your business valuable and unique can give you an advantage during negotiations.

Identify the key strengths and competitive advantages of your business. This could include a loyal customer base, a strong brand reputation, intellectual property, or proprietary technology. Highlighting these unique selling points can make your business more attractive to potential buyers and enhance your bargaining power.

Highlight any positive trends in revenue growth, cost reduction, or cash flow improvement. Demonstrating that your business is on a path to recovery can strengthen your negotiation position.

By knowing and leveraging your strengths while maintaining a collaborative approach, you can negotiate effectively and secure the best possible deal for the sale of your failing business.

Step 5: Crack the Deal or Move On to the Next Buyer

After going through the previous steps of addressing financial problems, maintaining relationships with potential buyers, and negotiating effectively, you will reach a crucial point: deciding whether to seal the deal with a buyer or move on to the next opportunity.

Assess the Offer:

Carefully review the terms and conditions of the buyer's offer. Consider factors such as the purchase price, payment structure, transition period, contingencies, and the overall fit with your objectives. Analyze how well the offer aligns with your desired outcomes for selling your failing business.

Evaluate Feasibility:

Evaluate the feasibility of completing the deal with the interested buyer. Assess the buyer's financial capability to follow through on the agreed-upon terms. Consider their track record in executing similar transactions and their ability to secure financing, if necessary.

Seek Professional Advice:

If you need clarification on the offer or guidance in making a decision, consult with professionals such as experienced business brokers, lawyers, or financial advisors. They can provide insights and expertise to help you make an informed decision based on your unique circumstances.

Make a Decision:

Based on your assessment and analysis, accept the buyer's offer or move on to the next opportunity. If you decide to proceed, work with your advisors to finalize the legal and financial documentation. If you choose to move on, resume identifying and engaging with new customers.

Remember, the decision to crack the deal or move on should be guided by your goals, priorities, and the best interests of your failing business. By carefully considering the offer, analyzing the fit, and seeking professional advice, you can make a well-informed decision that aligns with your desired outcome.

Step 6: Be Patient, Highlight the Value, and Make an Exit

In the final step of selling your failing business, it's important to exercise patience, highlight your business's value, and successfully exit.

Selling a business can take time, especially when dealing with a failing business. It's crucial to remain patient throughout the process. Remember that finding the right buyer who understands the potential and aligns with your business values may require time and effort. Stay committed and resilient during this stage.

| Important! |

|---|

| Patience is your ally in selling a failing business. Highlight its value, engage with the right buyers, and navigate negotiations effectively. A successful exit requires resilience, commitment, and careful consideration of each step. |

Highlight the Value:

Continuously emphasize the value and potential of your business to prospective buyers. Showcase any improvements made, growth opportunities identified, or operational efficiencies implemented. Present comprehensive financial and operational data to demonstrate the potential return on investment for buyers. Highlighting the value increases the chances of attracting serious and interested parties.

Make a Successful Exit:

Once you have successfully negotiated a deal with a suitable buyer, it's time to exit. Ensure that all legal and financial aspects of the sale are properly documented and finalized. Collaborate with professionals, such as lawyers and accountants, to facilitate a smooth transition and transfer of ownership. Be prepared for any necessary handover processes, including the transfer of assets, customer relationships, and key business information.

Step 7: Contact a Business Broker for Help

Contacting a professional business broker can be highly beneficial if you want assistance selling your distressed business. A business representative can provide expertise and support throughout the process, helping you achieve a profitable exit. We at the ExitAdvisor.oi can help you in various ways.

- Expertise and Experience: We specialize in facilitating the buying and selling of distressed businesses. We have extensive knowledge of the market, industry trends, and evaluating techniques. Our expertise can guide you through the entire process, from preparing your business for sale to finding qualified buyers.

- Access to a Network: We have a vast network of potential buyers, investors, and industry contacts. We can tap into this network to find suitable prospects to acquire businesses like yours. This can significantly increase your chances of finding a buyer quickly.

- Confidentiality: Selling a distressed business requires sensitivity and confidentiality. At ExitAdvisor.oi, we understand the importance of maintaining confidentiality throughout the process. We protect your business's identity, ensuring that only serious and qualified buyers know the opportunity.

- Valuation and Pricing: Determining the right value for your distressed business can be challenging. ExitAdvisor.oi has experience in valuing businesses based on various factors such as financial performance, assets, market conditions, and growth potential. We objectively assess your business's worth and help you set a realistic asking price.

- Negotiation Skills: Negotiating the terms of a sale can be complex and require skillful handling. We have experienced negotiators who can represent your best interests and ensure you secure a favorable deal. We know how to navigate challenging negotiations, address concerns, and reach agreements that satisfy both parties.

- Increased Sale Potential: Working with ExitAdvisor.oi can significantly increase the sale potential of your distressed business. We have the knowledge, resources, and connections to market your business effectively, attract qualified buyers, and maximize the value of your sale.

Remember, partnering with a business rep, ExitAdvisor.oi, can streamline the selling process, improve outcomes, and relieve some of the burdens of selling a distressed business.

| Did You Know! |

|---|

| Highlighting positive trends, whether in revenue growth or operational improvements, during negotiations can significantly enhance your bargaining power. Showcase the potential for a turnaround to attract buyers. |

Why Do Businesses Fail and Lose Money?

Businesses can fail and lose money due to various reasons. Here are some common factors that contribute to business failure:

- Lack of Funding or Working Capital: Insufficient and inadequate working capital can hinder a business's growth and operations, leading to financial difficulties and eventual failure.

- Cash Flow Problems: Poor cash flow management is a significant reason many small businesses fail. Inadequate revenue generation, high expenses, and improper financial planning can result in unsustainable cash flow issues.

- Absence of Effective Business Planning: A lack of a well-defined business plan can hinder a company's ability to strategize, adapt, and navigate challenges effectively.

- Team-related Issues: Problems such as the wrong team composition, lack of skills, disagreements among partners, or an inability to attract and retain talented individuals can hinder a business's success.

- Poor Planning and Execution: Inadequate business planning, including issues with inventory management, marketing, and sales strategies, can significantly impact a business's profitability and sustainability.

- Rigidness and Inflexibility: Failing to adapt to emerging trends, technologies, or customer preferences can prevent businesses from becoming stagnant and losing their competitive edge.

Understanding why businesses fail and lose money can help entrepreneurs identify potential pitfalls and make informed decisions to mitigate risks. Business owners need to address these factors proactively and seek professional advice when needed to increase their chances of success.

What Is the Best Way to Find a Buyer for a Failing Business

Finding a buyer to sell your business on the market can be challenging, but you can employ several effective strategies. Here are some of the best ways to find a buyer to get a true value of money-losing business:

- Engage a Business Broker: Working with a good business broker specializing in distressed businesses can be highly beneficial. They have experience and a network of potential buyers who may be interested in acquiring struggling businesses. A business seller can help you market your business, identify qualified buyers, and negotiate the sale.

- Tap into Your Network: Leverage your personal and professional network to spread the word about your business's availability. Contact industry contacts, colleagues, suppliers, and customers who may know someone interested in acquiring a failing business. Word-of-mouth referrals can be powerful in finding potential buyers.

- Online Business Marketplaces: List your failing business on online marketplaces that cater to buying and selling businesses. Websites such as BizBuySell and BusinessBroker.net allow you to advertise your business to a wide audience of potential buyers actively seeking acquisition opportunities.

- Industry Associations and Trade Shows: Attend industry events, conferences, and trade shows related to your business's niche. These gatherings provide excellent opportunities to connect with potential buyers interested in acquiring a business in your industry. Networking and establishing relationships can lead to potential buyer leads.

- Utilize Social Media and Online Marketing: Leverage the power of social media platforms like LinkedIn, Facebook, and Twitter to showcase your failing business and its potential value. Craft compelling posts highlighting unique selling points, assets, or growth opportunities. Additionally, consider utilizing targeted online advertising to reach potential buyers within your industry.

Finding a buyer for a failing business may take time and effort. Presenting your business accurately and transparently is crucial, highlighting potential opportunities for improvement or turnaround. Consider seeking professional advice to ensure the best possible outcome during the sale process.

Frequently Asked Questions

Can You Sell a Failing Business?

Yes, it is possible to sell a failing business. However, selling a failing business can be more challenging than selling a successful one. Finding a buyer who sees potential or opportunities for turnaround may require extra effort, transparency, and effective communication.

How to Sell a Company With No Revenue?

Selling a company with no revenue can be difficult, but it is not impossible. Highlight any unique assets, intellectual property, market opportunities, or growth potential the business possesses. Secondly, develop a comprehensive business plan outlining a path to revenue generation and profitability. Finally, target buyers who may see value in acquiring the company for reasons other than immediate revenue, such as gaining access to technology, customer base, or market positioning.

How to Sell a Failing Startup?

Selling a failing startup requires a different approach compared to a successful one. Consider these steps:

- Evaluate the reasons for failure: Understand and address the key issues contributing to the startup's failure. Be prepared to discuss them openly with potential buyers.

- Showcase assets: Highlight any valuable assets, intellectual property, patents, customer base, or technology developed during the startup's journey.

- Seek strategic buyers: Look for buyers who may benefit from acquiring the startup's assets, technology, team, or market positioning.

How to Sell a Business That Is Not Profitable?

- Analyze the reasons for the lack of profitability:

- Be prepared to discuss them openly with potential buyers.

- Showcase any valuable assets, intellectual property, customer base, market share, or growth opportunities the business possesses.

- Look for buyers who specialize in turning around struggling businesses or have the resources to implement necessary changes.

- Consulting with professionals like business brokers can provide valuable guidance throughout the selling process.

Conclusion

Selling a failing business can be a challenging but not impossible task.

You can increase your chances of finding a potential buyer by utilizing strategies such as networking, targeting competitors or similar businesses, advertising in local media, and leveraging social media and online marketing.

It is also essential to consult with professionals and present your business transparently with a clear improvement plan.

You can successfully sell your struggling business and move towards a new chapter with perseverance and effective communication. Remember to stay positive and open to potential opportunities throughout the selling process.